Investing in Fixer-Uppers – A Complete Guide To Buying Low…

description

...Fixing Smart, Adding Value, And Selling (or Renting) High

Local pick-up preferred, but will ship at the buyer’s expense

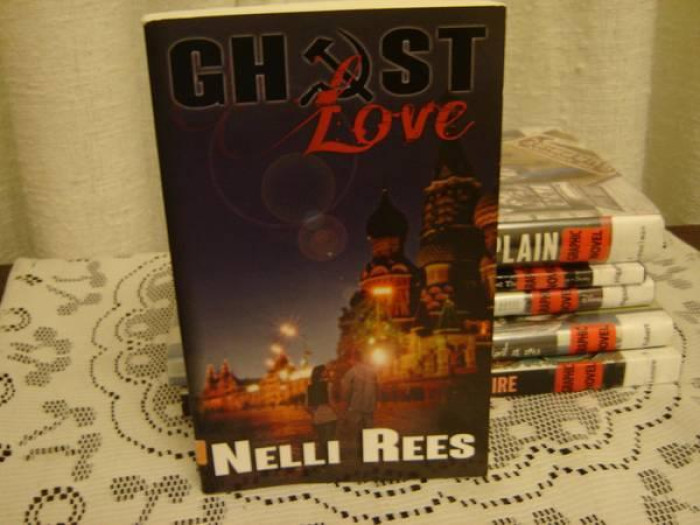

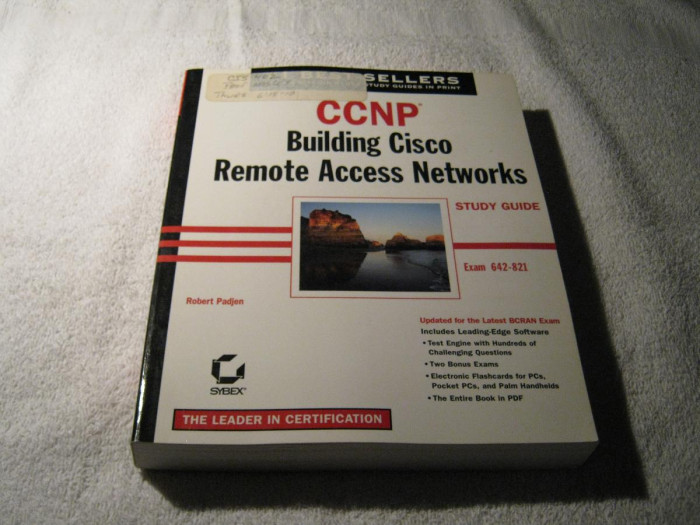

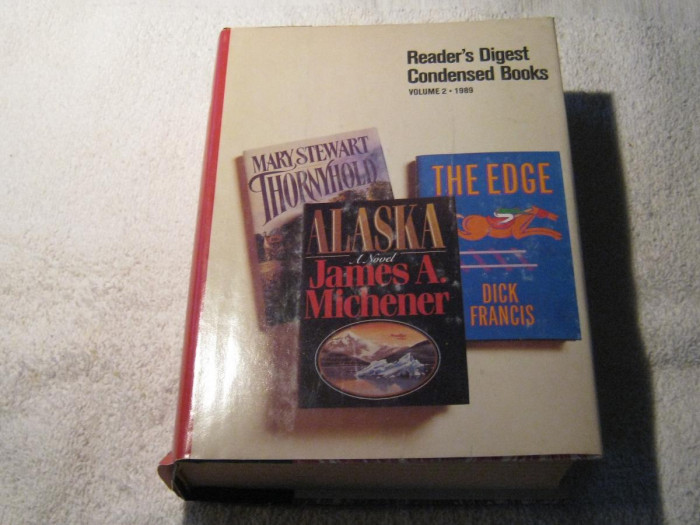

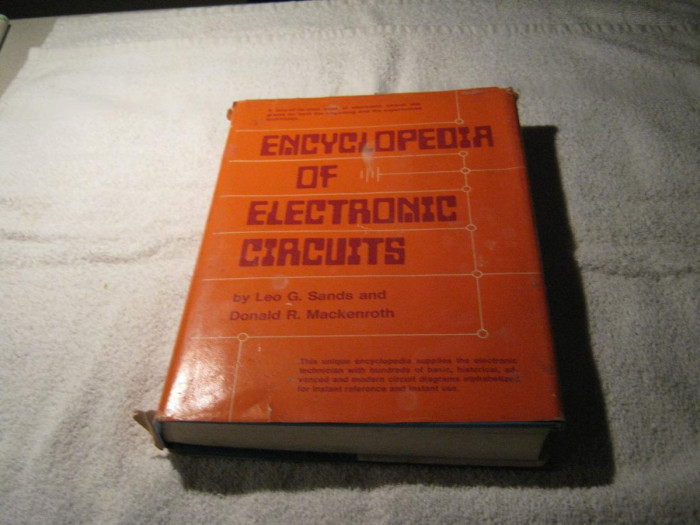

Kingston – Books 13 – IMG_4680

Author: Jay P. DeCima

Publisher: McGraw Hill

**Expert money-making advice from the nation's leading fixer-upper guru**

_"Excellent book on the fixer strategy."--John T. Reed, bestselling real estate author_

_"Filled with practical examples of how to profit from rundown fixer-upper properties."--Robert J. Bruss, syndicated real estate columnist_

Nobody wants to buy an ugly, decrepit, rundown house--which is exactly why they provide real estate investors with the best bargains! In _Investing in Fixer-Uppers_ , nationally known real estate guru Jay DeCima reveals how investors can add thousands of dollars to the value of an "ugly" house. He discusses how to substitute personal skills for traditional down payments, strategies to profit without waiting for appreciation, and dozens of other value-adding tips.

Contents by Chapter

Introduction

**Part One. Getting Started in Fixer-Uppers**

1. **How to Make $1,000,000 Working Smarter**

White Picket Fences Provide Big Payback

Fix-up Profits vs. Wages at the Sawmill

Making Serious Money Requires Extra Helpers:

Compounding and Leveraging

Where Does All the Money Come From?

It Doesn’t Cost a Ton of Money to Begin

Why Fixers Are the Perfect Place to Start

The “Adding Value” Strategy and Why Properties Must Have Potential

Less Competition Always Equals Better Value

1. **The Heywood Houses: A Textbook Fixer-Upper**

Classified Ads Can Sometimes Lead to The Goldmine

Find What You’re Looking for and Act Quickly

Fixing People Problems Is Worth Big Bucks

Flexible Sellers Provide High-Profit Opportunities

Good Financing Sets the Stage for Big Profits

Looking for Loans in All the Wrong Places

Fixer Skills Turn Ugly Duckling Into Beautiful Swan

To Make Big Money You Need a Profit Plan

The End of a Very Profitable Season

Waiting for “Mr. Good Buyer”

1. **The Profit Advantage Using Fix-up Skills**

Learn to See the Money-Making Potential in Ugly Houses

Only Two Methods to Make Money in Real Estate

Selecting the Right Strategy Is Key to Success

Fixing Up Looks and Management Earns Profits

Fixing Houses is Equal Opportunity for All

Save 70% Doing Your Own Fix-Up

Fix-up Skills Earn Average Wages but Knowledge Builds Fortunes

Sizzle Fix-Ups Provide High Investment Returns

Biggest Payday Comes from Knowing Where to Kick

Size Yourself Up – What Are You Capable of?

1. **How to Get Started Investing in Fixer-Uppers**

Getting Started Ranks First

Continuing Education – A Must

Specialization Is the Quickest Way to Learn This Job

Real Estate Investors Must Think Like Business Folks

Jay’s Formula for Making Money in Real Estate

Investing My Way – Four Basic Ingredients

It’s Important to Position Yourself to Make Money

If You’re Short on Knowledge or Money, “Adding Value” Strategy Is a Perfect Opportunity

Looking for Mr. Right, Not Mr. Perfect

Selecting a Property That’s Right

Finding Seller Who Truly Want to Sell

Don’t be Stopped by Lack of Cash

Don’t Buy Until You Know How Much to Pay

Spreading the Risk

Diversification Later Is the Best Strategy

The Best Odds for Your Success

10 Must-Do’s That Will Speed Up Your Success

**5\. Funding the Right Properties and a Motivated Seller**

The House Detective Approach

Before You Invest, Do Your Homework – Obtain a Property Profile

The Four Basic Methods of Finding and Buying Fixers

Finding Sellers Who Truly Need to Sell

Most Common Reasons That Motivate Sellers

Key Factors for Making a Bargain Purchase

Beware of Over Financed Property

Looking for Owners with Equity

Avoid Deals Like **HUD** , **FHA** , and **VA** Foreclosures

It Pays to be Snoopy

What to Do When You Find the Right Property

Equity and Profits Are Greater with Larger Properties

The Courage to Look Where Other’s Don’t: Nontraditional Properties

Break Ranks with the Typical Buyer

1. **My** **Yellow Court** **Houses: The Right Property and Sellers Make for a Profitable Deal.**

Why Banks Want to Unload REO’s

Timing is Everything, from Wine-Making to Real Estate

Determining How Much to Pay

Making an Offer

Affording the Fix-Up

Success!

The Goal Is Finding Profitable Deals

**7\. Good Realty Agents Don’t Cost You Money – They Help You Make It**

How to Find and Agent Who’s Right for you

Five Important Benefits and Agent provides

No-No’s to Avoid If You Expect Loyalty

Your Real Estate Agent Can Help You Build Wealth

**8\. The Price Is Determines by Income and Location**

Complex Formulas Are Not necessary

What Are Gross Rent Multipliers and Why Are They Important?

Selecting the Right Location

Five Common Locations and Their Investment Potential

How to Calculate What You Should Pay

Jay’s Super Simple Profit Strategy: Up the Rents and Improve the GRM

There’s a Time to Sell and a Time to Buy

Real Estate Prices Go Up and Down

Rely on Cash Flow, Not Speculation About the Future

Overpaying – The Deadliest Investor Sin

Investing Long Term for Future Growth

1. **Thoroughly Analyze the Deal Before Making an Offer**

Study the Numbers and Keep it Simple

Unit Cost and Rent-to-Value Ratios: How to Determine if a property Will Be Profitable

Jay’s Income Property Analysis Form

The Basis for Negotiating a Purchase

The Most Controversial Expenses

Always Get a Second Opinion

1. **Negotiating Deals That Earn Big Profits**

Real Profits Don’t Come from Playing Games

Developing the Right Approach

Winning over the Seller Leads to Winning Negations

Don’t Play Games if You Want Real Benefits

The Three Most Important Buyer Objectives

Your Chief Negotiating Tool

It’s Always Best to Let the Seller Participate

Verify Actual Expenses

Favorite Concessions for Buyer to Ask For

Typical Negotiations Work Like This

Successful Negotiations Put Money in Your Pocket

1. **Jay’s Moneymaker Foo-Foo Fix-Up Strategy: What to Fix and What to Leave Alone**

Don’t Fix Things That Don’t Pay You Back

Most Buyers and Renter’s Lack Vision

What You See Counts for Everything

My Two-Part Fix-Up Strategy

What You See Is The Foo-Foo

The Fo-Fo Cover-Up Strategy Exposed

Sizzle Fix-Up Offers the Biggest Profits

Houses with All the Right Things Wrong

The Fix-Up Revolution – Made to Fit and Ready to Use

How to Estimate What the Job Will Cost

Knowing What to Fix

Recovering Fix-Up Costs

Keeping Your Eye on the Ball

1. **Where Do All the Profits Come From?**

Playing the Appreciation Game

The Magic of Compounding

Four Ingredients That Produce Profits

Leverage Let’s You Soar with the Eagles

Not Everything Can Be Measured in Dollars

Brain Compounding Can Increase Your Wealth

Don’t Walk Away from Your Gold Mine

Adding New Profit Bulbs on My Money Tree

My First Profit Bulb and Best Source of Continuous Income

Fixer Jay’s Favorite Profit Bulbs

1. **The Ingredients of a Super Deal: The Hillcrest Cottages**

Creating Equity with Very Little Cash

Hillcrest Cottages – A Million-Dollar Problem

Knowing the Real Reason for Selling Is a Big Advantage

Hillcrest Purchase: Zero Cash Down

The Hillcrest Cottages Transaction

Fixing up Hillcrest Cottages

Selling the Fixed-up Hillcrest Cottages

Removing the Risk from a “No-Down” Sale

**Part Two. Creative Financing**

1. **The Value of Seller Refinancing**

Borrowing Money from the Bank Is Good for the Bank

New Bank Loan’s Should Be an Investor’s Last Choice

Buyer’s of Ugly Properties Get the Best Terms

Seller Financing Is the Cadillac of All Financing

Financing That Fits the Needs of Both Parties

Buying Back Your Own Debt Is Worth Big Bucks

1. **Investing with Others: Small Partnerships**

Why Would Anyone Want a Partnership?

Partnerships Must Be Based on Mutual Needs

Looking for Partners: The Selection Process

How to Find a Money Partner

Jay’s 60/40 Rule for Investing with a Money Partner

A Simple A-B Partnership Plan

Alternate Partnership Plan: Option to Purchase

A Tenants-in-Common Partnership

A Partnership Design is Negotiable

The Partnership Promise: A Co-Ownership Agreement

Never Invest Without a Written Agreement

Finding Money When You Don’t Have Any

A Sample Co-Ownership Agreement

**16\. Sell Half the Property to Increase Your Income**

The Best Computer in the World Doesn’t Help Broke Investors

50% Sales Can Greatly Improve Cash Flow

The Task is to Quickly Fix Up the Property and ADD Value

Rents and Gross Multipliers Go Up Together

How to Market a Fixed –Up, Fixer Property

Converting Negative Cash Flow into Positive

**17\. Jay’s 90/10 Money Partner Plan for Cash-Poor Investors**

How the 90/10 Plan Works

For Just 10% Cash, I Receive 50% Profit

High Returns and Buying power Are Keys to Plan

Contributions Are Equal for Both Investors

The Main Street Apartments: An Ideal 90/10 Partnership

Give More of Yourself Than You expect in Return

1. **Financing with Seller Subordination**

Seller Subordination: A No-Money Technique That Works

Loan Terms are More Important That Interest Cost

The Attraction of Southside Property

An Ideal Candidate for My30-30 Seller Subordination Plan

Where Does All the Money End Up?

How Does a Seller Benefit?

Advantages to the Buyer

Lenders Want Clean, Sweet-Smelling Properties

Paying Back the Seller’s Note

No Limit to Creativity in Real Estate

Variable Rate Mortgages Offer Another Option

Investor’s Success Requires Borrowed Money

Making Yourself a Better Borrower

Bankers Like Homeowners with Steady Jobs

Banker Enemy Number One: An Unemployed Loan Applicant

Jay’s Five Basic Financial Documents for Borrowing

1. **Free Fix-Up Money form Uncle HUD**

More Than One Way to Profit

Uncle Sam Provides money for Fixing Affordable Houses

Fix Up Your Rental Properties for Half the Normal Price

How to Get Started from Scratch

Dealing with the Local Housing Authority

No Money Down Deals Are Very Possible

Selecting the Right Property

Multi-Units Earn You More Profit for Each Dollar Spent

Watch Out for the Hidden Costs

HUD Assistance with My Viola Cottages

City Loans Work in Tandem with Grant Funds

The Flip Side: Other Requirements by the City

The City is a Flexible Lender

The Easiest Loan in Town

The Application Process: Steps to Take with Properties You Own

It Pays to Learn What Makes City Housing Tick

You Help Yourself Most When You’re Helping Others

1. **Buying back Mortgage Debt for Bonus Profits**

Setting the Stage for Discount Profits

Look for Property with Private Mortgages

Most Sellers Would Rather Have Cash

When and How to Talk about Discounting the Mortgage

Jay’s Red Mustang Strategy

Where You Negotiating Skills Will Earn The Greatest Profit

Timing is Critical: Buy Back the Mortgage **_After_** Purchasing the Property

Factors That Motivate Sellers to Give Discounts

The Top Reasons Why Mortgage Holders Sell for Discounts

Finding the Right Mortgages Is Well Worth the Search

Note-Buying Strategy Requires Detective Work

Jay’s Christmas Letter Generates Profits Year-Round

Value, Like Beauty, Is in the Eye of the Note Holder

Investors Need a Healthy Financial Diet

1. **Landlording Skills Can Make You Very Wealthy**

We Do It for the Money

The Dream: Working for Yourself

Total Control over Money Decisions is Key

Proprietorship – A Must

Success Means Wearing Many Hats

The First Rule of Business Is to Define Your Customer

Reasons Behind My Renting Strategy

Increasing My Odds for Success

The Value of Tenant Cycling

Keys to Good Management Are Action and Enforcement

You Must Always Get the Money First

Good Tenant Records are Essential

Don’t Take Shortcuts with Formalities

The Application Form – What You Need to Know

Rental Contracts Don’t Need to Be Complicated

Large Deposits Provide Added Protection

Tenant Urgency – Not My Urgency

Landlords Must Know the Law

Owners Should Do Evictions

Repairs and Customer Service

Obey the Laws of Habitability

1. **Tips for Dealing with Tenants**

Your Tenants Are Your Customers

Fewer Rules Are Best – but Be Sure to Enforce Them

Limit Improvements to What the Rent Can Support

Cut Down on Repair Visits – Get the Details over the Phone

Collecting the Rents and Knowing Where to Draw the Line with Deadbeats

Noncontact Management Works Quite Well

1. **The Big Picture and Long-Term Wealth**

Don’t Get Bogged Down with Routine Stuff

Join the Real World of Investing: Finding a Mentor

The Dream Alone Is Not Enough

Looking for Gold Buried in Mud

High Rent-to-Value Ratio Indicates Profits

I didn’t Grow Up to Be a Landlord

Avoid Doom and Gloom like the Plague

Roadblocks – Your Momentum Will Carry You Around Them

Positive Cash Flow Makes It All Worthwhile

**Appendix A. Income Property Analysis Form**

**Appendix B. Typical Property Sketch**

**Appendix C. Sample Co-Ownership Agreement**

**Appendix D. Resources for Real Estate Investors**

**Index**

**About the Author**

Paperback 336 pages ISBN: 9780071414333